About Mileagewise - Reconstructing Mileage Logs

About Mileagewise - Reconstructing Mileage Logs

Blog Article

Mileagewise - Reconstructing Mileage Logs Can Be Fun For Anyone

Table of ContentsSome Known Factual Statements About Mileagewise - Reconstructing Mileage Logs The Mileagewise - Reconstructing Mileage Logs PDFsThe Only Guide for Mileagewise - Reconstructing Mileage LogsTop Guidelines Of Mileagewise - Reconstructing Mileage LogsSome Of Mileagewise - Reconstructing Mileage LogsThe 2-Minute Rule for Mileagewise - Reconstructing Mileage LogsMileagewise - Reconstructing Mileage Logs Fundamentals Explained

Timeero's Fastest Range function recommends the quickest driving course to your staff members' location. This attribute improves performance and contributes to set you back savings, making it a necessary property for organizations with a mobile workforce. Timeero's Suggested Route attribute better enhances accountability and performance. Employees can contrast the suggested course with the real path taken.Such a method to reporting and compliance streamlines the frequently complicated job of taking care of mileage expenses. There are numerous benefits connected with utilizing Timeero to keep track of gas mileage.

Examine This Report about Mileagewise - Reconstructing Mileage Logs

With these devices in operation, there will certainly be no under-the-radar detours to boost your compensation expenses. Timestamps can be located on each mileage entrance, increasing reliability. These added verification actions will keep the IRS from having a factor to object your gas mileage documents. With precise gas mileage tracking innovation, your employees don't need to make harsh mileage quotes or perhaps fret about gas mileage cost monitoring.

If a worker drove 20,000 miles and 10,000 miles are business-related, you can compose off 50% of all automobile expenses (mile tracker app). You will require to continue tracking mileage for job even if you're making use of the actual expense technique. Keeping mileage documents is the only means to separate business and personal miles and supply the proof to the IRS

A lot of mileage trackers allow you log your journeys manually while calculating the range and reimbursement quantities for you. Numerous likewise included real-time trip tracking - you need to start the app at the start of your journey and quit it when you reach your final location. These apps log your start and end addresses, and time stamps, together with the overall range and repayment quantity.

4 Easy Facts About Mileagewise - Reconstructing Mileage Logs Described

This includes prices such as gas, upkeep, insurance, and the automobile's depreciation. For these expenses to be thought about deductible, the vehicle needs to be utilized for organization objectives.

The Of Mileagewise - Reconstructing Mileage Logs

Begin by recording your vehicle's odometer analysis on January first and then once again at the end of the year. In between, vigilantly track all your service journeys writing the beginning and finishing readings. For each and every journey, document the location and organization function. This can be simplified by keeping a driving log in your automobile.

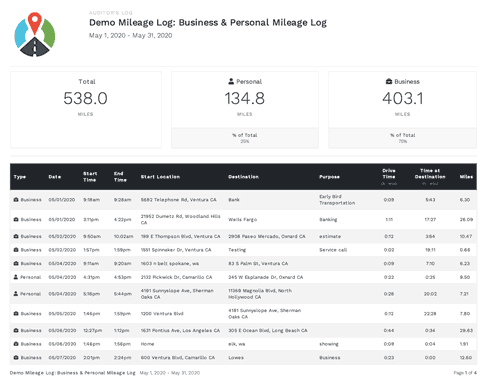

This consists of the complete organization mileage and complete gas mileage accumulation for the year (service + individual), journey's day, location, and purpose. It's vital to videotape tasks without delay and preserve a synchronic driving log detailing date, miles driven, and business function. Here's exactly how you can enhance record-keeping for audit functions: Start with making certain a careful mileage log for all business-related traveling.

Some Known Details About Mileagewise - Reconstructing Mileage Logs

The actual expenses technique is an alternative to the standard mileage rate approach. Rather than calculating your deduction based upon an established rate per mile, the actual expenses approach allows you to subtract the actual costs related to utilizing your automobile for business objectives - best free mileage tracker app. These expenses consist of gas, maintenance, fixings, insurance coverage, depreciation, and other associated costs

Those with considerable vehicle-related expenditures or special conditions may profit from the real costs approach. Eventually, your picked approach ought to align with your specific monetary goals and tax scenario.

The Greatest Guide To Mileagewise - Reconstructing Mileage Logs

(https://justpaste.it/ek2h2)Whenever you utilize your auto for service trips, record the miles traveled. At the end of the year, again write the odometer reading. Calculate your complete service miles by utilizing your beginning and end odometer readings, and your videotaped organization miles. Properly tracking your exact gas mileage for service trips aids in confirming your tax obligation deduction, specifically if you go with the Criterion Gas mileage approach.

Keeping an eye on your gas mileage manually can call for persistance, yet keep in mind, it can save you cash on your tax obligations. Comply with these actions: Jot down the day of each drive. Record the complete gas mileage driven. Consider noting your odometer readings prior to and after each trip. Write down the starting and finishing factors for your journey.

Unknown Facts About Mileagewise - Reconstructing Mileage Logs

In the 1980s, the airline market became visit homepage the very first industrial individuals of GPS. By the 2000s, the shipping sector had taken on general practitioners to track packages. And currently nearly every person utilizes GPS to get about. That suggests almost everybody can be tracked as they set about their service. And there's snag.

Report this page